We conducted a Zoom session last February 18 afternoon for our CFC Community in the UAE on updates of the products and services offered by the Social Security System (SSS) and the Home Development Mutual Fund or popularly called Pag-IBIG Fund. We had for the second time Mark Roue Oliva, Foreign Representative of SSS based in Dubai, and Lowella Recto, Member Services Officer of the Pag-IBIG Dubai Member Services Desk.

They first presented to our community in September 2020 as we were concerned at that time on how our brothers and sisters who lost their jobs or who got infected by the Covid-19 can avail of the benefits as SSS and Pag-IBIG members. The recent session was geared towards preparing ourselves for our eventual retirement as well as for earning additional income.

According to Lowella, the minimum contribution as a Pag-IBIG member is only Php200 per month ‘but we do encourage especially overseas-based Filipinos or OFWs to pay more that the required amount to have a bigger loan and returned of savings in the future’. There are two saving programs: the regular Pag-IBIG or P1 and the Modified Pag-IBIG 2 or MP2.

The MP2 is a special savings facility with a 5-year maturity, designed for Pag-IBIG members who wish to save more and earn even higher dividends, in addition to their Pag-IBIG Regular account. The MP2 program is also open to pensioners and retirees who were former Pag-IBIG Fund members. The minimum MP2 savings is PhP500 per month.

Once a member’s MP2 Savings reaches its 5-year maturity, the member can re-apply for a new Pag-IBIG MP2 account. “I myself have benefited from the MP2 program. I withdrew my matured MP2 account and the dividend earned from it was used to tour my family in the Phililppines. The principal amount was again deposited to a new MP2 account,” explained Lowella. The other benefits of being a Pag-IBIG member are the Housing Loan Programs and Short Term Loans for calamity fund and multi-purpose loans.

“For members who are already inactive, they may continue their contribution by paying the current year to become active again,” added Lowella. And for those OFWs who are not yet members, she said to register via http://www.pagibigfund.gov.ph.

In 2022, the amount collectively saved by Pag-IBIG members totaled P79.9 billion – the highest in the agency’s 42-year history. The total savings collected last year increased by 25%, or P16.2 billion from the P63.7 billion collected in 2021. Forming part of the total savings is the agency’s Pag-IBIG Regular Savings, which also increased by 6% from P37.71 billion in 2021 to P40.06 billion in 2022. These facts and figures were mentioned in a press release recently issued on February 3.

The SSS is a state-run, social insurance program in the Philippines to workers in the private, professional and informal sectors. It was established by virtue of Republic Act (RA) No. 1161, better known as the Social Security Act of 1954. This law was later amended by RA No. 8282 in 1997. On February 7, 2019, RA No. 11199 or the Social Security Act of 2018 was enacted to rationalize and expand the powers and duties of the Social Security Commission (SSC) to ensure the long-term viability of SSS.

Starting this year, the contribution rate increased to 14 percent from 13 percent in the previous year. Under the new contribution rate, employers will shoulder the one percent increase, which means their contribution will now be at 9.5 percent. The remaining 4.5 percent will be deducted from the employee. This is applicable only in the Philippines. For OFWs, the amount of contribution ranges from Php1,040 to Php3,250 per month.

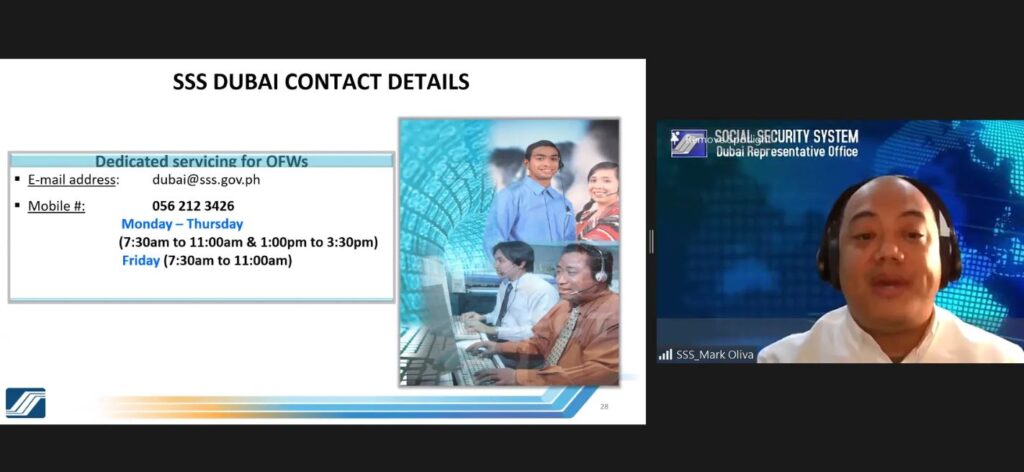

Mark said that if an inactive member still knows his or her SSS number then they just have to visit any money exchange houses in the UAE or pay their current year contribution online to re-activate their SSS membership. “Payment of contribution will trigger to change their current membership to OFW,” he added. “If they are not yet a member of SSS, they can apply and secure their SSS number online from this link – https://www.sss.gov.ph/sss/

“Since I’m a government employee, we are compulsory covered by GSIS, however, I continue to contribute to SSS as a voluntary member and have availed the sickness benefit four times, two of which when I contracted Covid-19 last year,” shared Mark. Sickness and Maternity benefits are extended to members who have at least three monthly contributions within 12 months before the semester of sickness, injury, childbirth, or miscarriage.

The other benefits include retirement, death, disability, funeral, and unemployment insurance or involuntary separation benefits. These benefits are closely linked to the amount and number of contributions, with the minimum monthly pension guaranteed.

If you are having second thought of re-activating your membership or applying as new member in both SSS and Pag-IBIG then read this testimonial from retired UAE petroleum industry professional and elder in the CFC Community, Arnel Batusin, who is now in Batangas City:

“I am benefitting from my SSS membership especially the monthly pension I am receiving after I retired at age 60. I am able to spend it for buying my health maintenance meds instead of getting the money from our fixed monthly income from our condo and apartment rentals which are just enough for me and my wife’s monthly expenses. On the Pag-IBIG Fund, when I went home for good I was able to refund it all which helped me augment my savings that time. My advise is to become an SSS member and invest in SSS because of the financial assistance it can give you later especially when you retire from work as what I mentioned. For Pag-IBIG, I know there are lots of benefits and privileges you can avail of and that’s why I advise everyone to have this, too.”

So what are you waiting for? Re-activate your SSS and Pag-IBIG memberships or apply as new members. Now.