A Facebook post by Filipino content creator Travel with Hafiz has gone viral after shedding light on the stark contrast in travel tax systems between the Philippines and other countries in Asia and the Gulf. With over 52,000 followers on Facebook, Hafiz’s post quickly gained traction, generating over 9,000 shares, 744 comments, and thousands of reactions from frustrated netizens.

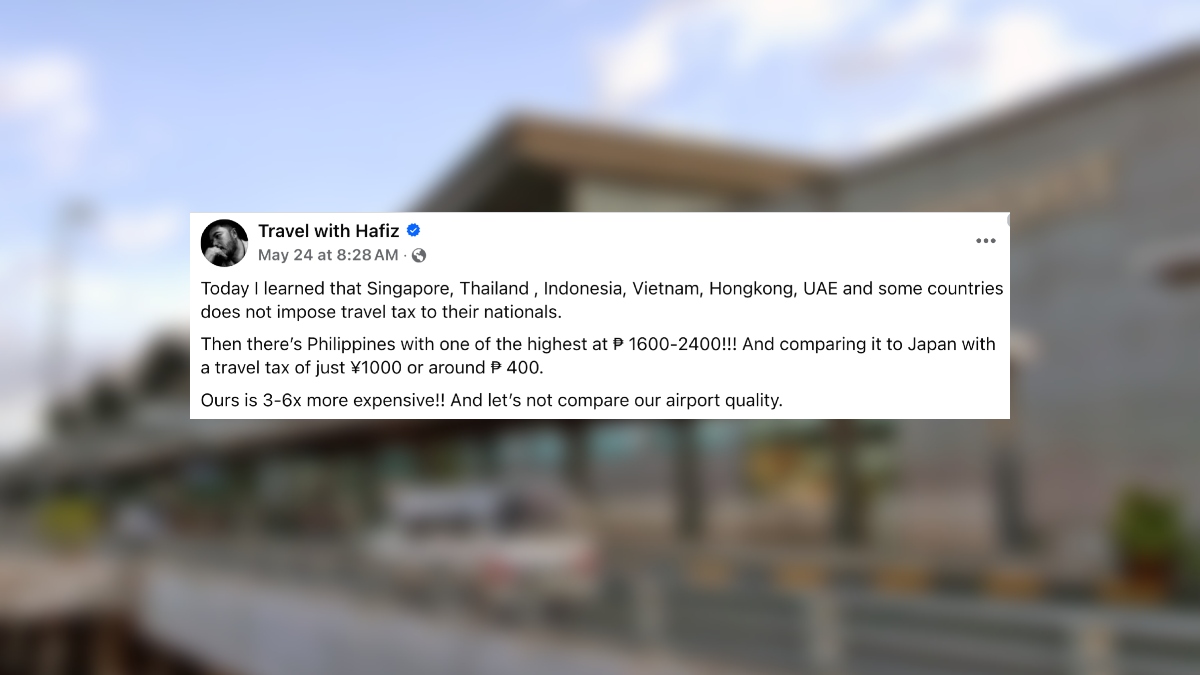

“Today I learned that Singapore, Thailand, Indonesia, Vietnam, Hong Kong, UAE and some countries do not impose travel tax to their nationals,” Hafiz wrote. “Then there’s Philippines with one of the highest at ₱1,600–2,400!!! And comparing it to Japan with a travel tax of just ¥1,000 or around ₱400. Ours is 3–6x more expensive!! And let’s not compare our airport quality.”

His frustration echoed the sentiments of many Filipinos online who shared their personal experiences and criticisms in the comments section. One user, Ria Jane Noveno Delasas, recounted, “Most of the passengers na nakasabay namin sa shuttle ay mga foreigners and they keep on telling na ‘it is (NAIA) the most chaotic airport they’ve ever been in’. Mga words na ‘gross’, ‘worst’ and they even described Phil aircrafts unsafe. Kaming mga Filipino hindi nalang nakaimik.”

The comment section became a space for satire and outrage, with users coining sarcastic terms like “FEE-lippines,” “We are the milkmaid,” and “Too much Crocs to feed.” Another netizen quipped, “Pang ayuda daw ‘yung tax,” suggesting that the tax collections are diverted to cash assistance programs. Dex Cabrejas broke it down in a satirical rant: “Middle class, you should work harder if you want to travel… Rich, barya lang ‘yan. Super rich, they don’t even probably buy tickets (char). Illegal, what tax?”

Others criticized what they perceive as an unjust system that places heavier financial burdens on local travelers. “Mas mahal pa ‘ung tax ng mga local na Pilipino kesa sa foreign libre,” one netizen commented, while another added, “Only in the Philippines ₱1,600 = $28, it hurts their pocket.”

The conversation also reflected broader dissatisfaction with the country’s infrastructure. “Imagine one of the worst airports in the world charging you with gaddeym amount of money?” wrote Royce David Miclat Sacdalan. Talia Salik-Bacalso added, “Taxes and VAT everywhere, even digital world they didn’t let it slide.”

This public outcry comes against the backdrop of a wide variety of tax regimes across Asia. Singapore, often praised for its business-friendly environment, imposes personal income tax rates between 0% to 24% for residents and up to 24% for non-residents. Meanwhile, Thailand, Indonesia, and Vietnam have progressive tax structures that cap at 35%—but none impose travel tax on their nationals.

In stark contrast, Hong Kong and the United Arab Emirates (UAE) boast highly attractive tax systems. Hong Kong offers a flat 15% option and progressive rates capped at 17%, while the UAE imposes no personal income tax at all, only a 9% corporate tax and a 5% VAT. These strategies are designed to stimulate foreign investment and maintain regional competitiveness—goals many Filipinos online believe their government should emulate.