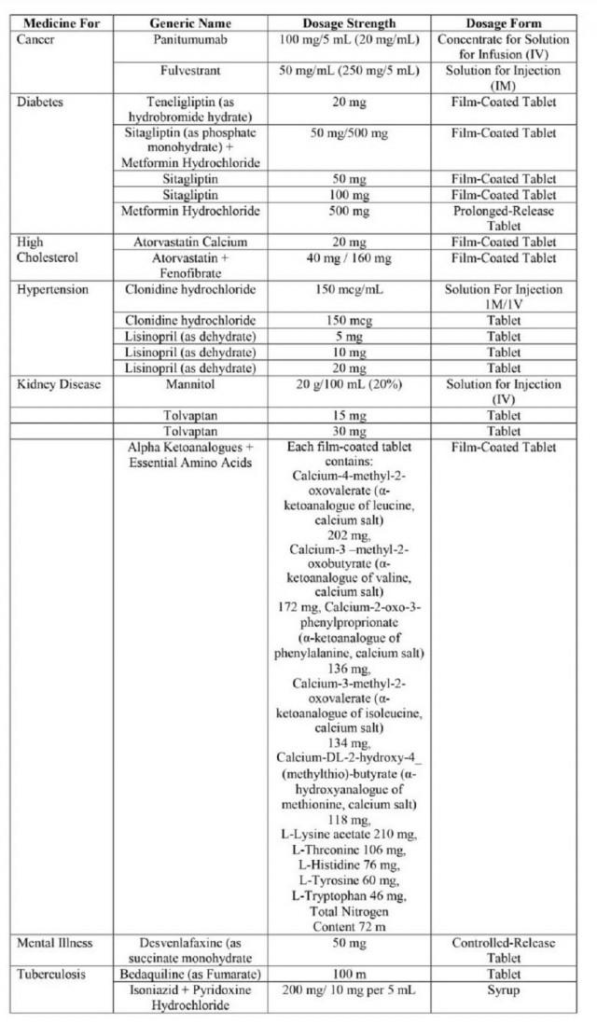

The Bureau of Internal Revenue (BIR) has announced the exemption of 21 medicines used for treating various diseases, including cancer, diabetes, hypertension, kidney disease, mental illness, and tuberculosis, from the value-added tax (VAT).

Internal Revenue Commissioner Romeo Lumagui Jr. issued Revenue Memorandum Circular No. 17-2024, marking these medicines as VAT-exempt. This decision came following a letter from the Food and Drug Administration (FDA) of the Department of Health (DOH), which endorsed an update on the list of VAT-Exempt Products under Republic Act No. 10963 (Tax Reform for Acceleration and Inclusion) and RA 11534 (Corporate Recovery and Tax Incentives for Enterprises Act).

Commissioner Lumagui emphasized that “Updating the list of VAT-exempt medicines is part of Taxpayer Service. We will update taxpayers as soon as possible of exemptions given to them by existing laws.”

Health Secretary Ted Herbosa welcomed this move, acknowledging the positive impact it would have on individuals suffering from these illnesses. He explained, “I welcome that because these are drugs that are needed by people who are really sick. So VAT exemption is very important because it lowers the price of medicines.”

Herbosa also highlighted the potential benefits of cheaper medicines, stating, “One of the things I want to do in primary care is to make medicines more available. And if the medicines are cheaper, more people could be given such through the budget that the Congress gives me. It would be of big help if the medicines became cheaper because of the removal of VAT.”

Commissioner Lumagui expressed the BIR’s commitment to prioritize excellent taxpayer service in 2024, with a focus on easing the financial burden of Filipinos suffering from these diseases. He stated, “Excellent Taxpayers Service will be the focus of BIR this 2024. This includes the issuance of circulars that would ease the financial burden of Filipinos that are suffering from the said diseases.”

Lumagui concluded, “Ito ang handog ng BIR sa Bagong Pilipinas, serbisyong mabilis at maaasahan. Ito pong 21 na gamot na tinanggalan ng VAT ay simula pa lamang ng mga serbisyong aming ibibigay ngayong 2024,” emphasizing the commitment of the BIR to provide swift and dependable services to the people of the Philippines.