In August 2024, gold reached a historic high of over $2,500 (approximately P140,000) per ounce, with its value continuing to rise. By September 20, 2024, gold prices climbed further to around $2,636 per ounce. This surge marks gold’s increasing role as a safe-haven asset, favored by investors and central banks for its stability amid inflation and economic uncertainty.

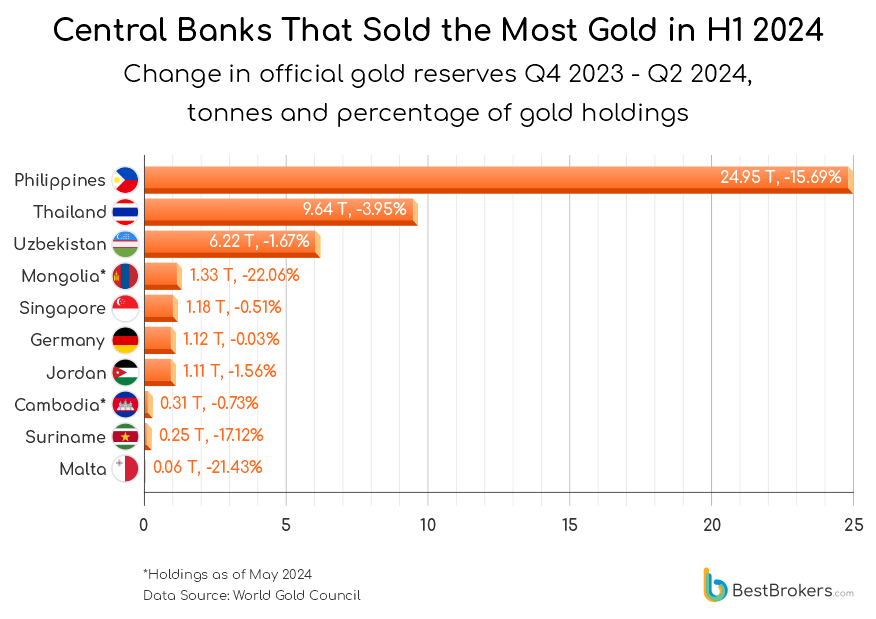

A recent report from BestBrokers reveals the Philippines as the top seller of gold during the first half of 2024. The country sold nearly 25 tons of gold between January and June, leading to a significant 15.69% reduction in its reserves, now standing at 134.06 tons. This contrasts with last year when the Philippines increased its gold reserves by 1.33 tons.

Despite being a gold-producing country, the Philippines’ sales highlight the Central Bank’s obligation to purchase locally mined gold. OceanaGold Philippines Inc., which operates the Didipio gold mine, sold over 26% of its annual gold production to the Bangko Sentral ng Pilipinas (BSP) in recent years, exceeding the 25% minimum required by law.

Other countries also saw shifts in their gold reserves in 2024. Turkey was the top buyer, adding 44.74 tons in the first half of the year. India and China followed closely, with India increasing its gold reserves by 37.18 tons, and China by 28.93 tons.

As of August 2024, the U.S. holds the largest gold reserves globally, amounting to 8,133.46 tons, followed by Germany and Italy.