Sending remittances back to the Philippines is a vital lifeline for many Overseas Filipino Workers (OFWs) in the UAE. These remittances provide essential support for their families, covering daily expenses, education, healthcare, and other necessities. For many, the intention behind working abroad is to ensure a better life for their loved ones back home. However, traditional remittance services often come with high fees and inconvenient processes. Fortunately, Taptap Send offers a game-changing solution with zero remittance fees, making it easier and more cost-effective to send money to the Philippines.

Zero fees

Taptap Send stands out from traditional remittance centers by offering money transfers to the Philippines without any transaction fees. This is a significant advantage for OFWs, as it allows them to maximize the amount of money they send home. By eliminating fees, Taptap Send helps OFWs make significant savings, ensuring that more of their hard-earned money reaches their families.

Convenience

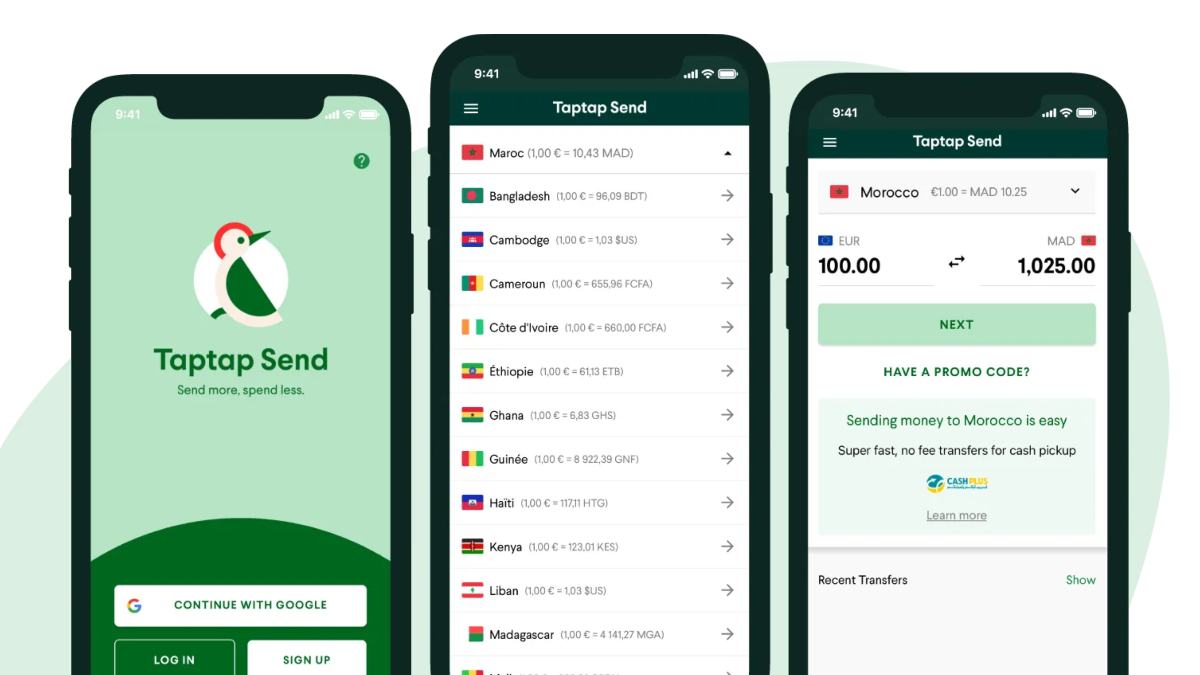

One of the most appealing features of Taptap Send is its convenience. As a mobile app, it allows users to send money on-the-go, eliminating the need to visit a remittance center and wait in long lines. This convenience is especially beneficial for OFWs with busy schedules, providing them with a hassle-free way to support their families.

Faster transfers

Taptap Send promotes instant transfers, ensuring that beneficiaries in the Philippines receive the money quickly. This speed is a considerable advantage over traditional remittance methods, which can take several days. Fast transfers mean that families can access funds when they need them most, whether for emergencies or everyday expenses.

Security

Security is a top priority for Taptap Send. The platform complies with UAE regulations and uses secure technologies to protect users’ information and transactions. This assurance of safety and compliance makes Taptap Send a reliable option for OFWs looking to send money home.

Growing trust

Taptap Send has rapidly become a trusted tool for Filipinos worldwide, with over 200,000 OFW users in the US, UK, Canada, Europe, and the UAE. Its reputation for providing a reliable and cost-effective remittance service continues to grow, making it an essential resource for the Filipino community.

How to use Taptap Send

Here’s a step-by-step guide for OFWs in the UAE on how to use Taptap Send to send money to the Philippines:

Downloading and signing up

Download the app: Install the Taptap Send app on your smartphone.

Sign up: Create an account by providing your basic information and a valid UAE mobile number.

Verifying your identity

Verification process: Taptap Send requires verification to comply with UAE regulations.

Upload documents: You’ll need to upload documents such as your Emirates ID and possibly proof of income (e.g., bank statement, utility bill).

Connecting your funding source

Link your card or bank account: You can connect your debit or salary card (Visa/Mastercard) or your UAE bank account.

Secure connection: Taptap Send uses a secure third-party platform (Lean) for this process, ensuring that your banking information remains confidential.

Sending money

Initiate transfer: Once your account is set up, you can start a money transfer.

Enter recipient’s details: Provide your recipient’s name and mobile number in the Philippines.

Specify the amount: Input the amount you want to send. The app will display the exchange rate and confirm that there are zero fees.

Confirm and send: Review the details and confirm the transaction to send the money.

Install the app now, visit this link.